3 Practical ways IFAs can grow revenue

Hatch

Financial Services

Growing an advice firm can feel like a lot of work for unpredictable rewards. Yet many firms already sit on opportunities that don’t require fresh spend or long, complicated projects. They come from the clients you’ve helped before, the agreements waiting to be updated, and the fees that you aren’t receiving. When these areas are handled well, they unlock revenue with far less effort than chasing cold leads or buying more businesses.

The three areas below are simple to action and create measurable impact without large marketing spend or lengthy internal projects.

Re-engage clients and prospects already in your database

Paid campaigns can work, but they tend to be expensive because they reach people with no existing link to your firm. The chances of a positive response from a cold approach are low. Your current database is usually far more valuable. You might not have been in touch with some of these people for some time, but they are much more likely to recognise your name, and that means a better chance of success.

There will be people who:

- Didn’t need an ongoing service when they first met you.

- Came for one-off support but never moved to your ongoing proposition.

- Felt able to manage things themselves but now lack time or confidence.

- Have since experienced major life changes.

- Are adult children of long-standing clients who now have planning needs of their own.

People’s circumstances shift, and those who weren’t ready previously may now be looking for help. A short, friendly email or call often reopens the conversation because they already recognise your name. This is simple, targeted client re-engagement that costs almost nothing yet regularly leads to new ongoing revenue.

If you want this process running consistently, automated email journeys and light-touch nurture campaigns tailored for financial advisers can keep this moving without adding work to your workload.

Re-paper clients quickly with digital signatures

If you’ve bought a client bank, changed your charging structure, or updated your service agreement, chasing signatures one by one slows everything down and delays revenue. While many firms rely on standalone tools, they can be costly and rarely fit neatly into the adviser workflow.

By using a system designed for financial advice firms, you can send documents at scale, track opens and completions, and set automatic reminders for anyone yet to sign. Integration with Intelligent Office or Xplan removes the manual list-building and stops version control headaches.

Clients are typically very comfortable signing paperwork digitally. We’ve seen the evidence. Speeding up your re-papering process means faster fee alignment, fewer admin delays, and far less time waiting for annual reviews to make simple changes.

Check for missed fees hiding in your data

Ad valorem charging is convenient, but fee leakage is common. Most firms don’t have every portfolio value on their back office fully up-to-date on the exact day payments land, which makes accurate fee reconciliation difficult. Providers occasionally make mistakes. When the numbers don’t match, underpayments often go unnoticed.

Across multiple firms, we’ve identified significant sums sitting unpaid because:

- Values weren’t updated.

- Incorrect terms were still active.

- Transfers or withdrawals had altered the expected fee.

Using AI-led data checks gives you a clear view of where money is missing and helps you correct payment terms quickly with the digital signature tools mentioned above. Pipeline tracking then gives you better visibility going forward.

This is one of the fastest ways for advisers to grow revenue without needing to win a single new client.

Making every part of your firm work harder

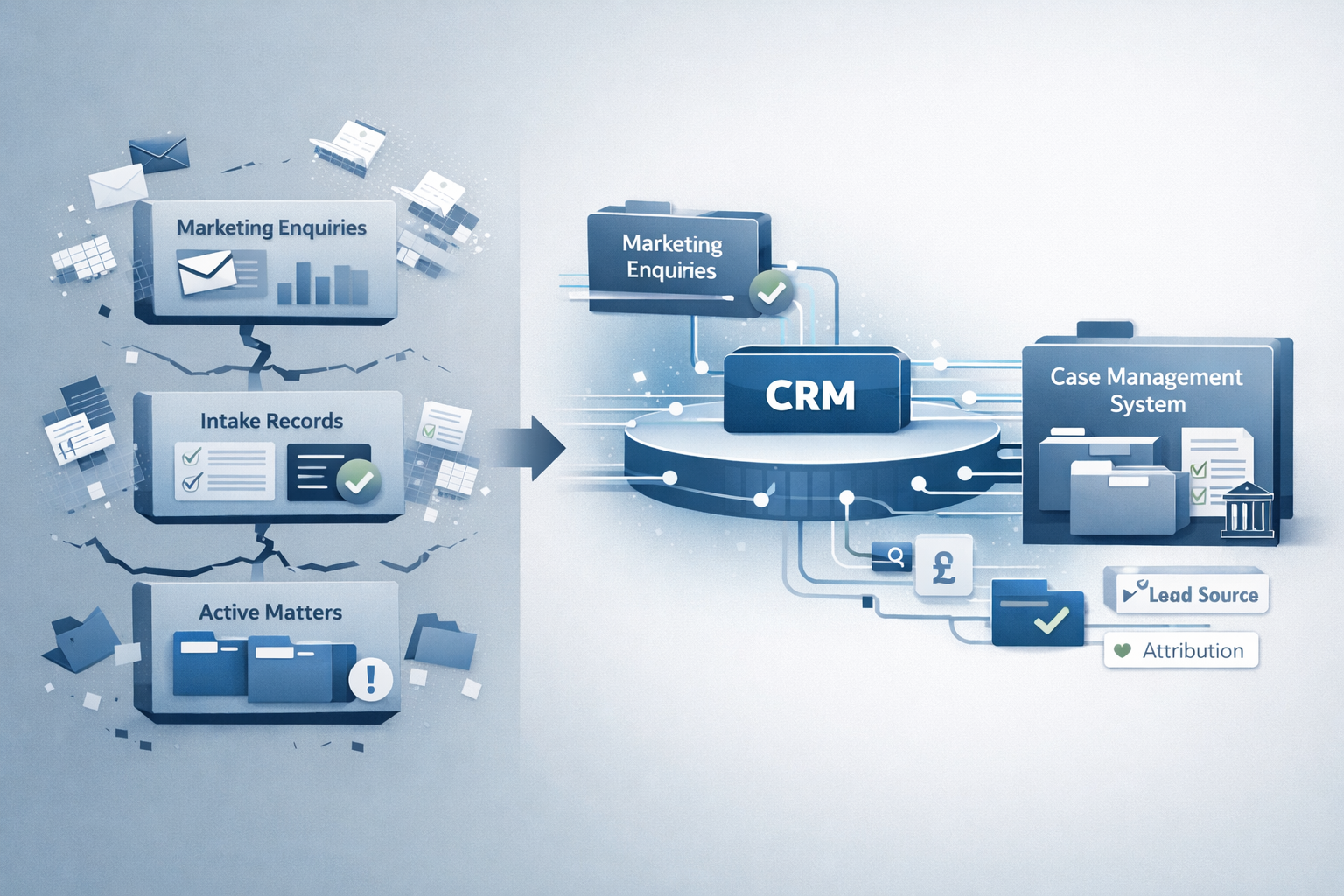

All three methods rely on clear communication, accurate client data and a joined-up system. When your firm has technology that supports those principles, revenue grows through better client contact, cleaner processes and fewer gaps in your fee flow.

If you’re ready to turn these three revenue-growth opportunities into dependable results, we can help you build the underlying system that makes it happen. Our custom integration with your existing back office system ensures your data flows, your client communications are automatic and you’re no longer manually chasing signatures or chasing missing fees. It’s how your data, systems and processes can really start to work for growth and not just compliance.

Find out how we make the tech side seamless for advisers: HubSpot for Financial Advisers & Planners