Why financial services firms struggle to trust their CRM reporting

Legal Sector

CRM

Leadership teams in financial services often sense something is off with their CRM reporting, even if they cannot quite put their finger on it.

Dashboards look sparse. Forecasts feel unreliable. Marketing reports raise more questions than answers. However, the issue is rarely that the CRM is broken. It is that the business never sees the full picture.

As our CRM Specialist, Jenny puts it:

“Most firms are working with snapshots of information”

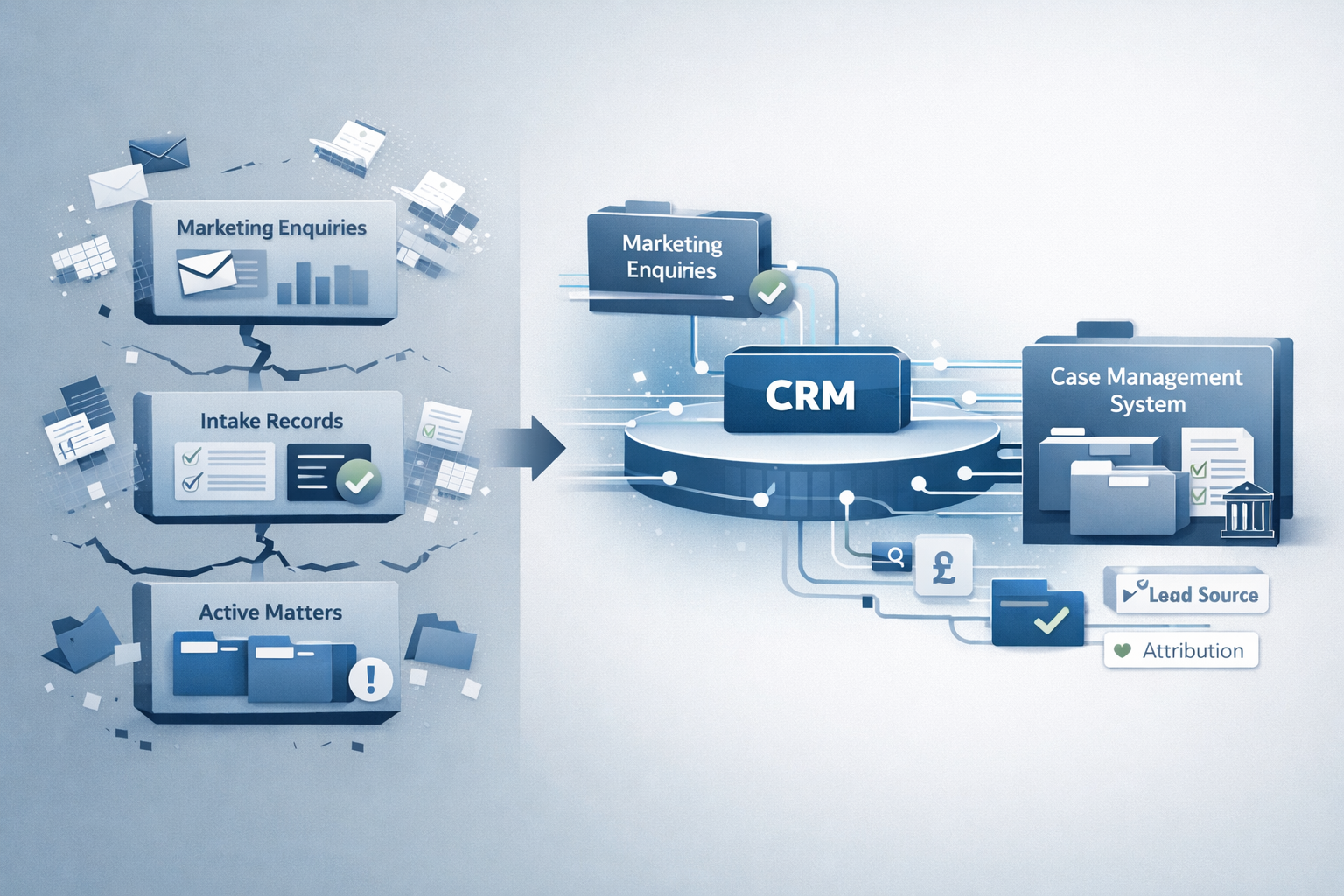

Meaning data exists, but it lives in silos. Wealth management platforms, trading systems, spreadsheets, marketing tools and the CRM all hold fragments of the story. When those systems do not speak to each other, reporting becomes partial at best and misleading at worst.

Decisions are made on incomplete data, and confidence in reporting erodes quickly at board level.

This article explores why CRM reporting breaks down in financial firms, even with the right technology in place. It outlines the common behavioural and system issues behind poor data, and what needs to shift if CRM is to support confident decision-making.

The numbers look right, but feel wrong

Disconnected systems create a dangerous blind spot for any firm. The CRM might show leads and early-stage activity, while revenue lives elsewhere. The result is reporting that looks technically correct but lacks substance. You can see activity, but not outcomes. You can see movement, but not impact.

We describe this as “Enough data to fill a dashboard, not enough to run the business.”.

Teams can extract data manually, cross-reference spreadsheets and try to stitch reports together, but this usually consumes hours each week and still fails to answer the real commercial questions.

Without a joined-up view, leadership cannot make sound calls on budget, resourcing, or growth priorities.

The cost of treating CRM as admin

When CRM adoption is low, advisors almost always revert to spreadsheets. This is not because spreadsheets are better. It is because the CRM has been framed as an obligation rather than a working tool.

We see this repeatedly with IFAs and wealth firms. Advisors log data because they are told to, not because it helps them manage their day. CRM use becomes a tick-box admin task instead of part of the workflow. Once that mindset sets in, data quality slips fast.

Signs of low CRM adoption culture in your firm:

- Deals without close dates

- Opportunities with no values attached

- Duplicate deals for the same client

- Little or no activity logged

- Pipelines that look busy but cannot be filtered, prioritised, or forecasted with any confidence.

While not ill-intentioned, these signs are a product of teams entering the bare minimum information required to move on. For example, advisors might log an opportunity quickly, then manage the real work elsewhere. The CRM becomes a digital filing cabinet, updated after the fact, rather than a system that actively supports decision-making.

ROI disappears between marketing and revenue

Ultimately the biggest casualty of disconnected systems and poor adoption is ROI reporting. The question marketing teams in financial services firms hear most often is “What was the ROI on that?”

A common example is a webinar:

Marketing plans it, promotes it, runs it, and generates enquiries.

Those leads move to another team, often into a different system or a spreadsheet, where opportunities are worked and eventually closed.

When leadership asks what revenue the webinar delivered, marketing cannot answer with certainty.

The data trail breaks the moment the opportunity leaves the CRM. Marketing can report engagement and attendance, but not revenue. That makes it almost impossible to justify future spend or argue for increased budget. From an SLT point of view, this creates frustration and hesitation. Without clear attribution, investment decisions become conservative by default.

HubSpot can solve this, but only if it is treated as the system where the full journey lives. Campaigns, contacts, opportunities and closed deals must be connected. Otherwise, the CRM simply mirrors the wider fragmentation in the business.

Why compliance isn’t the real issue

In financial services, compliance is often blamed for limited automation or cautious CRM use; however from our experience with clients that fear is often simply due to knowledge limitations.

HubSpot already includes granular permissions, audit trails, GDPR controls and data quality tools. Access can be restricted. Changes can be tracked. Records can be governed tightly.

The issue is rarely the platform’s capability. It is confidence and culture. Hesitation arises when CRM is positioned as risky or restrictive and that uncertainty is what causes teams to disengage. However, when it is framed as controlled and supportive, adoption improves quickly.

What changes when CRM becomes the system of record

The turning point comes when firms stop rolling out CRM as “another system” and start positioning it as the main hub.

When advisors see the CRM helping them prioritise opportunities, manage follow-ups, and work on the move through mobile tools, behaviour changes. Logging data stops feeling like admin and starts feeling useful. The CRM becomes a place where work happens, not somewhere it is recorded after the fact.

Trust in reporting only returns when the CRM reflects reality. That requires connected systems, consistent use, and a shared belief that the platform exists to support growth, not just oversight.